These documents should clearly define all details of the transaction without leaving any room for misinterpretation. This includes basics (like item specifications, unit quantities, pricing, and packaging) but should also cover shipping terms (also called Incoterms) and payment terms.

Shipping Terms (or Incoterms)

Incoterms (International Commerce Terms) are 11 standardized freight terms that must be agreed in writing between the supplier and buyer, or no air or ocean carrier will accept the shipment.

According to the International Trade Administration, the Incoterms® 2020 rules have been updated and grouped into two categories reflecting modes of transport—seven for any transport method and four for sea or land or inland waterway transport.

When importing from China to the USA, these Incoterms are commonly used:

◆EXW (Ex Works ): You take full responsibility and liability upon factory pickup of your order—from arranging, paying, to following up if there are any problems. Remember to add a clause to your purchase agreement that the supplier must help load the truck.

◆FCA (Free To Carrier): You take responsibility and liability once the shipment is handed over to the carrier, typically near the port.

◆FOB (Free On Board): You take responsibility and liability once the shipment crosses the ship’s rail. You will have to pay for the local charges between delivery to the carrier and loading on the vessel.

Although the International Chamber of Commerce (ICC) recommends using Incoterms® 2020 beginning January 1, 2020, vendors and buyers can agree to use any version of Incoterms after 2020, they just need to clearly specify the chosen version of Incoterms being used (such as Incoterms® 2010, Incoterms® 2020, or any earlier version).

Payment Terms & Methods

Chinese suppliers typically require a 30% deposit prior to shipping, with the remaining 70% is paid once the goods are received. This helps to mitigate the risk of theft on both sides. You don’t need to worry about currency conversion, as U.S dollars (USD) is the primary global currency, and majority of Chinese suppliers accept it.

You can send payments through the following methods:

1. Telegraphic Transfer (TT)

Telegraphic transfer (TT) payments are a standard electronic transfer of funds between banks, incur a smaller fee than other options, and are accepted by all Chinese suppliers. TT payments lack protection against theft but is still most recommended by import professionals, saying security can be better assured by doing your homework and personally vetting new suppliers.

2. Letter of Credit (LC or LOC)

A Letter of Credit (LC or LOC) is fund transfer that includes a level of insurance. You pay your bank, which then issues an assurance to the supplier. After your bank confirms that the exact quantity of items in your order has arrived at the correct destination, the vendor is paid.

The added security is helpful but might not be worth it because of the sizable fees. It’s very unlikely that a vetted supplier will take your money and run—the bigger risks that importers face are problems with item quality and shipping delays. An LC provides no protection against either of these possibilities, so it’s commonly used for very large transactions only.

3. Alibaba Trade Assurance

Alibaba offers a payment processing option that works similarly to getting an LC from your bank. You submit the payment to a designated Alibaba account (with the Singapore City Bank), then it’s released to the supplier once shipping is confirmed.

Unlike LC payments, Alibaba Trade Assurance will refund your money if the shipment is delayed beyond a specified date or if the quality of the goods is not compliant with the agreed product specifications.

This method requires both parties to have an Alibaba account, but it is free to use. The only fee that incurs is the cost of processing your initial payment to the Alibaba account.

4. PayPal

This option is secure and straightforward—but not commonly used by importers. PayPal charges very high transaction fees, and many suppliers don’t have PayPal accounts to accept the payment.

When it is used, PayPal is usually reserved for small, introductory purchases—such as samples and trial orders.

Product Specifications

Unlike domestic US dealings, having a hard-and-fast purchase contract isn’t particularly helpful when importing from China. As mentioned earlier, contracts don’t carry the same weight that they do in the US.

It does, however, help to include clearly defined product specifications that your supplier signs and agrees to. This document isn’t legally binding, but it greatly decreases your chances of winding up with a batch of low-quality, misrepresented products.

Along with your purchase order and invoice, submit a checklist or spreadsheet stating the product’s specs—such as weight, dimensions, color, material type, fabric thickness, component manufacturer, and labeling requirements. It also helps to create visual references when applicable (the more clear and straightforward you can be, the better). Here’s an example.

Product Specification Checklist

Item: Women’s chino pants, size medium

Fabric: Organic cotton, 200 gsm

Fabric Color: Pantone 443

Design: As specified in product_listing_image.png attachment

Dimensions: As specified in product_measurements.png attachment

Care label: As specified in label_design.png attachment

Zipper: YKK

California Prop 65 Compliant: Yes

CPSIA (US) Compliant: Yes

Dimensions Attachment

Showing dimensions of jeans.

Images, illustrations, and visual representations of product specs help to avoid any miscommunicated expectations. (Source: Medium)

Label Attachment

Step 4: Arrange Cargo Transport

Depending on the shipping terms of your order, you may need to facilitate inland transport, including export customs clearance and loading. But more often than not, orders placed with new suppliers will be on FOB (as explained above)—in which case these steps will be handled by the supplier. It is recommended to use a freight forwarder, such as Flexport, to handle import shipping.

Freight forwarders specialize in the logistics of cargo shipments—such as facilitate scheduling, tracking, insurance, and more. They can save you money by consolidating LCL (Less than Container Load) cargo with other deliveries. They also have access to volume discounts through partnered shipping companies—so they’re able to offer highly competitive rates.

When it comes to transport rates, sea freight is quoted by volume, whereas air shipments are quoted by weight. Using an air courier is the most expensive method, while booking air freight costs about half as much and choosing sea freight costs about 10% as much.

Air courier shipping is typically a door-to-door service, meaning your goods are shipped straight to their final destination. DHL, FedEx, and UPS are commonly-used air courier services. If your goods are valued at $800 or more, these carriers will provide customs brokerage services to get your shipment cleared for entry—although it usually incurs an additional surcharge.

Air and sea freight methods are booked from the port of origin to an airport or seaport near you. From there, you’ll need to arrange shipping to your final destination. This can be done by your freight forwarder or scheduled yourself using a freight broker. We recommend NTG (formerly FreightPros) as the best freight broker for small businesses.

Step 5: Clear Your Shipment Through Customs

Customs clearance is a critical part of importing from China. If you don’t provide the correct documentation and follow the right procedures, you run the risk of having your goods detained and/or examined—both of which result in delays and hefty fees. In the worst-case scenario, your merchandise is seized by CBP and destroyed or sold at auction.

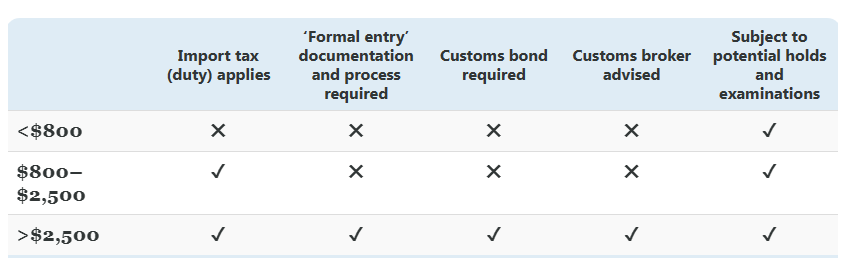

To obtain clearance from the CBP, you must take the necessary entry, examination, valuation, classification, and clearance measures. The customs process, costs, and requirements vary depending on the value of your shipment, as shown below.