Top Marketing Trends in the Hardware Retail Industry(USA)

According to the Home Improvement Research Institute, the home improvement industry is valued at approximately $220 billion per year, and this figure is expected to rise. Within the industry, products alone have an estimated value of $120 billion.

While many retail industries experienced sales declines in 2020, hardware retailing wasn’t among them. Unlike their counterparts, many hardware retailers benefitted from the increased focus on the home living space throughout 2020 and 2021. As consumers’ worlds shrunk to the four walls of their homes, they found time and a renewed interest in learning to tackle home improvement projects, leading hardware retailers to experience the second-fastest growth among retailers in the first half of 2021.

Before 2020, the retail landscape was increasingly digital-driven, but many brick-and-mortar retailers managed not only to survive but thrive without offering an online shopping experience. However, the Covid-19 pandemic caused swift and significant disruption to the retail industry, leaving many retailers to adapt their businesses to the online marketplace and find new ways to reach their existing customers and attract new ones.

As vaccination efforts spread and the country opens up, many business owners in the hardware retailing industry see their in-store traffic increasing again. However, the hardware retailing landscape isn’t likely to return to its pre-pandemic appearance. Customers who have adopted new methods of searching and shopping over the past year are unlikely to revert entirely back to old habits. Therefore, experts in the hardware retailing industry and digital marketing spaces need to create and implement data-driven physical and digital marketing strategies that continue to improve the customer experience and drive business in the coming years.

Market Research Reports on Hardware Stores and Retail

Market research data gives retailers and marketers insight into consumer’s habits wants and needs so they can position themselves to meet them. For example, quality market research can provide retailers with data about the products consumers are looking for and the type of content that they find engaging. It can also shine a light on emerging trends, allowing businesses to target new growth avenues or better personalize the shopping experience.

We’ve gathered some of the statistics and data from recent hardware retailing market research reports below. These insights, and others, can help retailers and marketers better understand the hardware retailing market and its customers, improve the customer experience, and develop robust digital marketing strategies.

Hardware & Home Improvement Retailers Market Trends

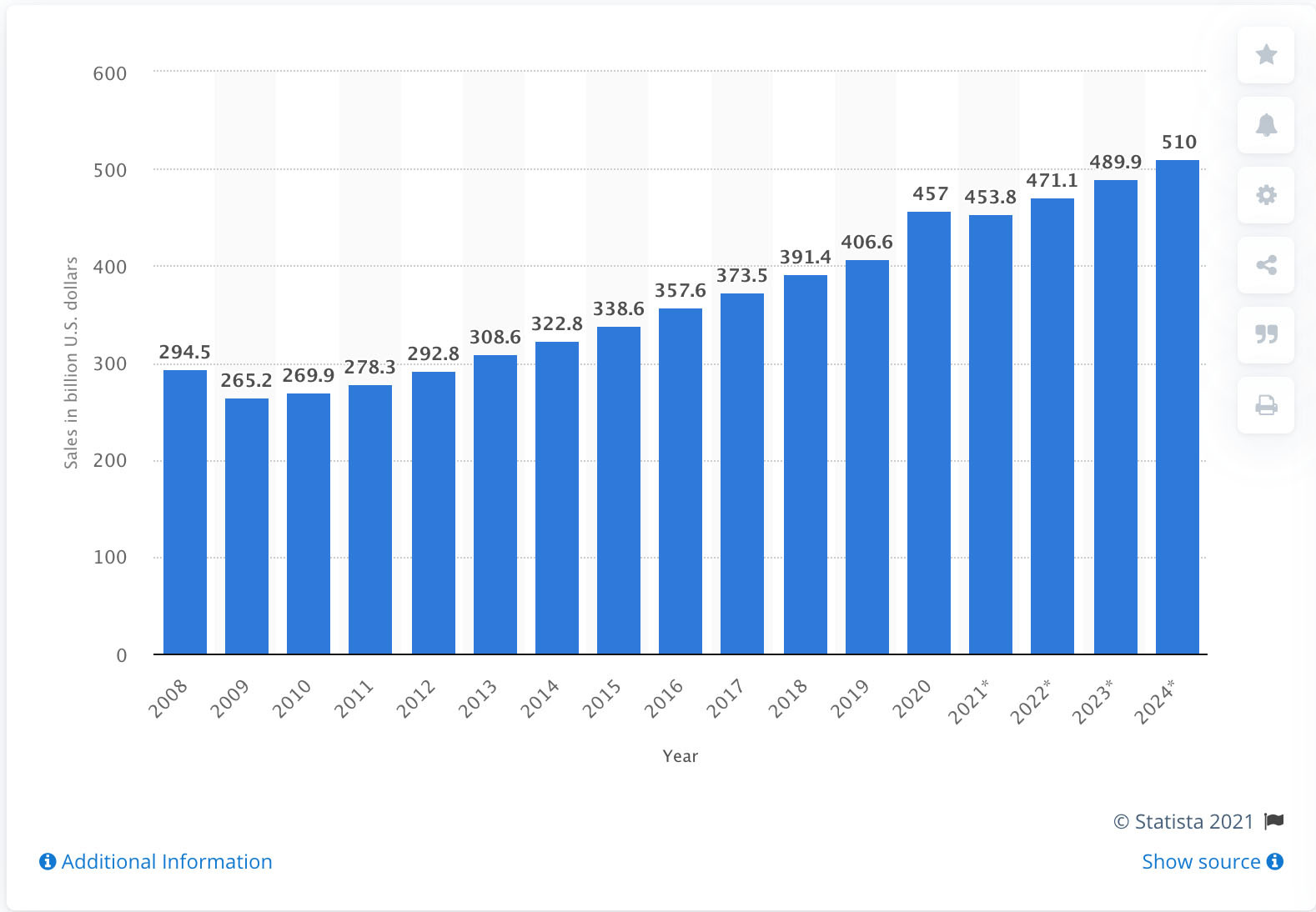

According to data from NPD Group based on the number of purchases made in-store and online, home improvement stores are the second-fastest-growing retail channel. In 2020, total sales in US hardware stores amounted to approximately $60 billion, increasing nearly $10 billion from 2019. Between January and May 2020 alone, online spending at Ace Hardware stores alone rose 647%.

After the unforeseen changes of the past year, many trends have emerged in hardware retailing that reveal an evolution in the industry and new opportunities for retailers.

Home appliance searches sharply increased in early 2020 and remain elevated over previous years.

Between 2020 and 2021, home remodeling searches doubled.

Conversions from organic traffic have received a steady and significant boost.

Younger consumers are taking on more DIY projects than they did pre-pandemic.

As these trends continue and evolve, hardware retailers and digital marketers will need to adopt strategies that reflect the changing landscape of consumer demand to remain competitive and meet consumers on this new terrain.

Home Appliance Searches Have Increased

In 2020, almost half of the US population made a home improvement purchase for their kitchen or bathroom. With many Americans spending more time in their homes than we ever had before, it seems we turned our attention to the minor annoyances around the house we may have overlooked in the past.

Stay at home orders also shifted the way many Americans shops. Those accustomed to making frequent shopping trips for groceries or other necessities began making more prominent, less frequent purchases intended to last weeks or even months at home. So it’s no surprise that home appliance searches increased by 26% over the past year, as Americans sought out refrigerators and freezers to store large amounts of food, dishwashers to tackle the neverending pile of dishes, and other appliances to make life at home more comfortable for everyone.

Home Remodeling Searches have more than DOUBLED from 2020 to 2021

Among respondents to a 2020 Statista survey about home improvement, 76% stated that they’d made at least one home improvement during the coronavirus pandemic. Within this group, 64% renovated their home’s exterior, while 58% made interior renovations.

Though homeowners may be spending less time at home in 2021, their remodeling and renovation plans don’t show signs of slowing down. According to the US Census Bureau, 55% of homeowners will start or continue home renovation projects this winter. In addition, 22% of these homeowners plan to spend between $5k to $15k.

With home improvement projects planned into 2022 and spending on home improvement growing twice as fast as other retail categories, consumers will turn to hardware retailers online and in-store for tools, supplies, and advice.

12% increase of Conversions from Organic Traffic (2019-2020)

Many hardware and home improvement retailers were deemed essential in 2020 and permitted to continue modified in-store operations. Still, they adapted to ensure they met the safety needs and comfort levels of both employees and customers, with many expanding their eCommerce presence and offering curbside pickup or local delivery.

Among online hardware and home improvement retailers, 2020 showed a 12% increase in conversions from organic traffic compared to 2019.

34% of DIY Projects are done by Younger People

Data from the Joint Center for Housing Studies at Harvard University found that 34% of homeowners under 34 are likely to tackle DIY home improvement projects, compared to only 18% of 45-54-year-olds. In addition, while younger homeowners take on a larger share of DIY projects, research shows that these tend to be simple, discretionary tasks such as lawn maintenance and decorating, while older homeowners tend to invest in larger, less DIY-able endeavors such as roofing, window, and siding replacement.

While DIY spending has been trending down for more than a decade, survey data from Lowes reveals 40% of consumers started a new hobby in 2020 involving tools or home improvement. In addition, 59% of respondents in the same survey reported their intent to alter their pre-pandemic spending habits so they could continue to spend on home improvement.

Conclusion

To stay competitive in a rapidly shifting marketplace, hardware retailers need to pair sound data and market research with a robust and adaptive digital marketing strategy. While independent local hardware retailers may not have the in-house data analysts or marketing teams of big-box retailers, they can stay competitive by listening to the market, monitoring trends, and executing strategies to capitalize on them.